I’ve been having technical issues around these parts. They’ve really drained the fun out of blogging. I just want to copy a section of an Excel spreadsheet into a blog post. Is this really that tough? No. It’s not that tough. My computer just hates me.

Because of my technical problems, I’ve been a bit of a scatterbrain. To indulge my scatterbrainhood, this post will be a bulleted list. Enjoy!

1. Retirement saving is awesome!

My 401k is now in the quadruple digits. It has a comma! woot woot!

In other retirement news! My Roth IRA is kicking butt and taking names. It was up like $650 in February. For only saving in my Roth for 2 years, this was such a huge swing to see. My Roth has also earned more than my 401k is worth. I doubt my Roth will be ahead of my 401k for much longer, so I’m excited to celebrate all of its achievements.

2. Hubs is awesome!

Hubs and I celebrated our 6th dating anniversary! I consider our dating anniversary to be a much more important date than our wedding anniversary. Our dating anniversary is the day the stars aligns and our worlds collided. Our wedding anniversary is the day our venue happened to be available. Yes, it was a magnificent day, but our love story started long before we said I do.

Every year we go back to where we met and have dinner. We had a wonderful time celebrating our relationship. We’ve really come into our own over the last few months and that has been so darn fun! Gosh, I love him.

3. My net worth is awesome!

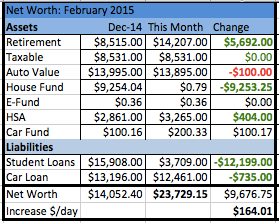

Drum roll please! I have a net worth and it’s positive! Yeee! Below is a snapshot over the last 2 months.

Assets!

Assets!

– Retirement: I drained our House Fund and split it between my student loans and Roth IRA. This maxed out my Roth for 2014! Also, now that I’ve been with my company for a year, I’m eligible for the company match! I bumped up my 401k percentage to take full advantage of that.

– Taxable: I love looking at this number. It’s a real life experiment for what happens when you invest $3000 at 16 and don’t touch it. #saving! I just wish it was in a Roth. #lamesauce I don’t have electronic access to my taxable investments. I rely on semi-annual statements. This will be boring for 10 months out of the year.

– Auto Value: The initial value was determined by Kelley Blue Book. I plan to drop my car’s value by $50/month.

– House Fund: Drained it! I can’t wait to start building this again!

– Emergency Fund: Livin’ on the edge! This isn’t as sketchy as it appears. Hubs has his own emergency fund, but this is my net worth gosh darn it! He has his own net worth!

– HSA: I maxed it last year, and I’m on track to max it again this year. We’ve had a few medical expenses come out of it, but for the most part, it is on the up and up.

– Car Fund: I save $50/month for my car. This counteracts the depreciation. I plan to use this to pay for any maintenance and eventually use it to buy a car for Hubs.

Liabilities!

– Student Loan: $3709. Down over $12,000 since January 1 and $2,631 since last month. I’m on track to have this paid off in 3 more paychecks. April 10, 2015! Here I come!

Also, my interest is officially under $1/day and that’s just fantastical.

– Car Loan: Minimum payment as promised.

Overall:

- Net worth: $23,729

- Net worth increase: $164/day

- This is averaging high to my bonus last month. Hopefully, I can ride the wave and keep it above $100 all year!

4. Everything is Awesome!*

Comb your hair!

Other Goals:

- Weight: Down 2 lbs. Not an awesome start to my new motivated life, but meh. I’ve got a few things up my sleeve that will hopefully kick this into gear. I have 11 weeks until my first race of season. I can totally do this.

* Had to. Couldn’t help myself.

How was your February? How many more times can you handle reading the word “awesome”?

LOL. This *is* awesome! It is a testament to the power of a good salary PLUS frugality. I love how hard you’ve been attacking those loans. As far as your technical difficulties: I take a screencap of my spreadsheet rather than trying to figure out how to cut and paste a segment. Seems to work ok.

Awesome! 😉 Salary plus frugality is certainly working! I’m still in a bit of disbelief for how well my plan of attack is working!

I was able to do screen captures, but that stopped working. I downloaded Gimp and that seemed to work. Now I have to learn Gimp!

You don’t have a Mac, do you?

I do have a Mac. I’m new to Macs so that’s not helping my confidence to figure it out. Any tips?

I think Apple Key+ shift + 4 lets you do a screen grab of an area/box you select. Whenever I add an excel box (or pretty much any other picture) that’s how I do it.

Interesting. I was doing essentially that through a program (“Grab”) and it saved it as a .tiff. Doing it your way saves it as a .png. Thanks for this! You win!!

Pingback: The Net Worth of Personal Finance Bloggers

Way to go on your goals. Bonuses really do make the difference. The second bonus I got at my company paid off the rest of our car loan (it wasn’t that high but still…) and start a decent emergency fund.

Our February sucked financially, and this month isn’t going to be great either. Too many home repairs. But my boss has agreed to let me do overtime, which will help get us to our goal of being able to pay for a major medical expense in cash in October.

So that’s something, I suppose.

That’s so awesome that you’re so close to having your student loan paid off! I’m still a few months off (aiming for July), but I can’t wait!

July is so soon!!! You will get there in no time! Isn’t the excitement fun as you get closer?

You are so awesome! Way to kill it 🙂 Dare I say it might even be “awesome”?! I’m so excited for you to finish up that last $3700!

My February was rough in some ways, but my personal finances look fine in the end. my rental finances on the other hand… ugh! I might have to borrow a bit from my personal account to square that all away.

Thanks Alicia. Sometimes I feel like things are going a bit too good to be true. But, if the curtain has to fall, I’ve got my fingers crossed that will happen after April 10th. I’m committed to that date!

Sorry your rental is being a bummer. Hopefully a new tenant will wipe the slate clean and you can have a more positive experience. Even if it’s still negative, I hope it’s less of a money suck. Here’s to a better March!

You had an awesome month! Awesome! XD

Thanks Pear! Really the only negative this month has been you making me jealous of all your trip planning! If I go on a crazy crash diet, will you let me be your checked bag? 😀

This post made me smile 🙂 Glad you had such a great month!

Yay! Smiles are my favorite.

SO much awesome going on here! Way to go on those student loans! You’re almost there!! Also, happy dating anniversary–that’s so sweet…. and awesome!

Thank you, thank you. I’m so close! Now I have to learn patience until I get there. notverypatient.

Awesome! I love your positivity. It sounds like all of your numbers are heading in the right direction!

Thanks Holly! Yes! Totally the right direction. Now to harness their power and let them grow 😀

Kate,

Haven’t visited your blog in far too long, but I’m really happy to see you’re net worth in the green! Awesome job! It goes to show that dedication and hard work do amount to something.

Looking forward to seeing your net worth grow over the coming months.

Congrats on the 6th dating anniversary!

Here’s to many more to come,

NMW

Waffles! So nice of you to stop by! Thank you! I’m so happy to have my net worth in the green! Now for it to grow, grow, grow!

All the best!