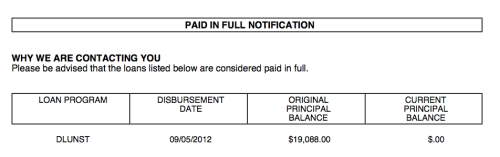

The time has come for me to wrap up my student loans, seal the box and send them on their way. I paid them off almost a month ago and the loose ends are finally tied up. The last loose end was my final Paid In Full confirmation from my loan servicer. When I submitted my final payment, I was notified that it could take up to 30 days to receive confirmation. So even though I made my final payment on March 27, I didn’t receive official confirmation until April 18! That’s 3 whole weeks of second guessing whether or not my loans were really paid off. As proof, here it is! woot!

Before I send my loans on their way and switch my focus to saving, I wanted to do one final analysis of all my numbers. To do that, I requested a full official record of my student loans from my loan servicer. Disbursements, Interest Capitalization, Payments, everything.

Requesting the record was pretty simple. I submitted my request through the online portal and it was sent to me within a week. Of course they sent it in a format that I couldn’t easily transfer into an Excel spreadsheet, but these are student loans. They aren’t meant to be easy. After some number crunching, here is what I came up with!

Total Amount Disbursed: $44,468

Before any interest or payments, the United States Government loaned me $44,468 to pay for my graduate school education.

Total Interest Paid: $5,474.50

Over the course of incurring and repaying my loans, I paid a total of $5,474.50 in interest. Three of my loans were unsubsidized, meaning they accrued interest while I was in school. On November 11, 2013, all accrued interest was capitalized onto the balance of my loans. This meant that I could pay interest on my interest. Oh joy! The total amount capitalized was $2,401.77. This would have been $461.10 higher, but I used my tax refund in 2013 to make a payment on my loans.

Number of Payments: 66

Holy crap, that’s a lot of payments over 16 months. That’s an average of 4 payments per month, but I was hitting 6 payments per month for most months toward the end. The biggest thing that hits me about this number is all but 16 of those payments were manual. That means me transferring money around and logging into FedLoan Servicing to make the payment. It’s going to be pretty weird not logging into that account again. It had been such a constant thing for me.

Largest Payment: $5,240.50 (House Fund)

Smallest Payment: $51 (Ain’t no payment small enough!)

Days in Repayment: 459

1 year, 3 months and 4 days. Technically, I made my first payment 3 days early so this could be 462 days, but I was just being generous. 459, it is!

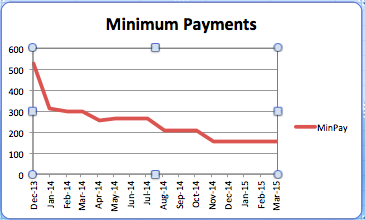

Evolution of my Minimum Payment: $525.86 – $154.63

- December: $525.86. My minimum payment on standard repayment.

- January: $311.xx. Immediately after I made my first payment and was still unemployed, I switched repayment plans to graduated standard repayment. This lowered my payment to $311 something. I paid $312 that month.

- February/March: $296.58. I paid off my first loan in February, resulting in a lower payment.

- April: $256.57. I paid off loan 2 in March. This dropped my minimum payment, but apparently more than it should have. This is why you need a buffer for your student loan account. This payment makes no sense.

- May – July: $266.34. After the mysteriously low April payment, my minpay went up $10 for the remainder of Loan 3.

- August – October: $205.77. With two loans left, I paid $205.77.

- November – March: $154.63. Finish line!

Total Amount Paid: $ 49,942.50

This amount represents the total amount paid for my graduate school education. It cost me $49,942.50 to go to Law School. This includes books, fees, transportation, The Bar Exam: prep classes and taking the actually test, a new computer, a professional wardrobe, and living expenses during school and while looking for a job over the 3.5 years.

I am over the moon that this is under $50,000. I barely made it ($57.50!) but hot damn! That feels freaking fantastic!

One thing noticeably missing from all these numbers is $45,330, the number I thought I was facing this whole time. I’m not sure where this number came from. It was probably the balance when I got my first loan payment notification, but it doesn’t fit nicely with any of the numbers I have now. Per my calculations based on the record of my account, my balance with the capitalized interest should have been $45,408 around that time. Close enough. Interest is a fickle thing.

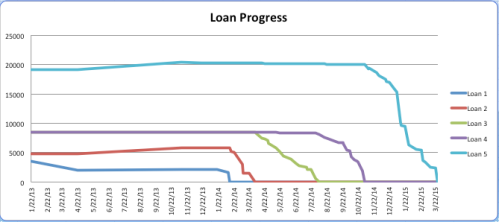

Now to the graphs…

1. Unburied

My favorite website for inspiration during my payoff was Unbury.me. I could plug in all my numbers and what I thought I could pay and it would give me a beautiful payoff schedule and a graph similar to the one below. I played around with that thing a lot. The best thing about it was that it clearly showed what an extra $50, $100 or $200 would do per month. If that doesn’t drive you to put extra toward your debt, I’m not sure anything will.

The biggest downside of Unbury.me was that you could only play with one month’s numbers at a time. My payments were inconsistent, so it was tough to get a gauge of what the upcoming months looked like. This, along with my aggressive payments, resulted in me always getting ahead of schedule. It was fun to get ahead of schedule, but it made planning difficult.

Now that my payment plan in finished, I have a full picture of what it all looks like. It looks pretty good!

Important Dates in order:

- April 2013: Made an early payment, knocking down my smallest loan.

- November 2013: Unsubsidized interest was capitalized onto the balance of my loan.

- February 2014: Things got serious. I had a steady paycheck and I could attack!

- January 2015: Drained my House Fund and took a big bite out of my last loan.

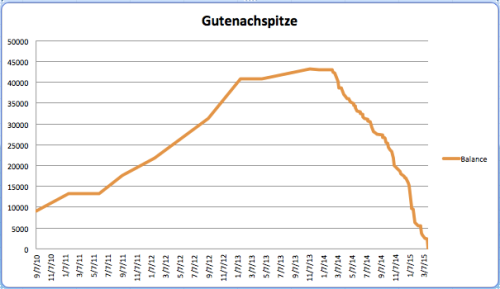

2. Gutenachspitze!

One of the metrics I wanted to look at was the lifecycle of my loans. How long did it take to incur the debt and how long did it take to pay them back? What did that all look like? When I charted the numbers, it was beautiful. To quote Rudy, it was “the most beautiful sight these eyes have ever seen.” Well, not quite, but beautiful all the same.

My debt resembles the mountain I always thought it was. I named it Gutenachspitze, or Goodnight Peak for those of you that don’t speak German.

I’m so proud of this mountain. I created it, but I also conquered it! Look at how steep it is on the east face. I did that.

Hubs and I did that.

I love this! Especially the mountain. Of COURSE it’s German 🙂 That was both an insanely cheap way to go to law school, and a truly awesome job knocking out the debt afterwards. You are so well set up for kicking ass and taking names in the future!

German mountains are the best mountains, but I have no facts to support this. Pretty proud of my cheap education! Scholarships for the win!

A huge huge congrats! You got a law degree out of all of that, and now you’re free. You’re free : ).

Thanks Brooke! Freedom is just starting to set it. It feels pretty awesome.

Good job! 😀 That’s an amazing feat you accomplished. 😀

Thanks so much Pear! It was pretty fun to put all the numbers together 🙂

Thank you so much for sharing! I’m waiting for the final 2 “paid in full” emails as well. I’m hoping that’ll help me realize that this is in fact over. It has been such a focus for me for the last 8 months!

Waiting is the worst! It’s been a month since I paid off mine and it’s only starting to seem real. It will come and you can start your post debt life! 🙂

Congratulations, Kate! I know a lawyer who is paying off her student debts, and one of the obstacles she runs into is the expectation of living up to a certain lifestyle. Most of us (like me – a teacher) don’t face that sort of pressure. Have you had any stress in going against the grain of high-living among your colleagues? Or even among others who think you must have lots to spend because of your profession?

Thanks and interesting question. I’ll write a post about it and get some insight from other attorneys that are in different lines of work. I’ve always been frugal and don’t have a standard attorney job, so I don’t face or feel many pressures to spend. We’ll see what others say!

That is so awesome! Congrats! Now you just have to figure out what to do with your extra cash =)

Save it!

Kate,

Excellent job and awesome statistics in this post! Thank you for sharing.

Pretty remarkable that you managed law school under $50,000 when I hear people throw numbers like $200,000 around all the time for such an education.

You’re in inspiration for everyone dealing with student loans!

Keep it up and make compound interest work for you instead of against you like it has in the past.

Best of luck,

NMW

Thanks so much Waffles! I’m really proud that it all came in under $50,000. I frugaled my way through school!

I’m on my way to making compound interest work for me. Gotta build that critical mass!

Best, Kate

good = gute

night = Nacht

peak = Spitze

there is a t missing in the word “Nacht”

Well, I tried.:) And I don’t have spreadsheet to fix it!