December was quite a whirlwind! Vacation, a new employee to manage, Christmas, and TWO dentist appointments. It was a heck of a month, this is true. But it also came with one heck of a schedule. I’m excited to have a little more routine, come January.

Fun Fact: I did not work a full work week during the entire month of December.

Week 1: Vacation, where this happened.

A splashing sea lion and the back of my head!

Week 2: Vacation + 2 day week, and this happened

Off to Hogwarts!

Week 3: 4.5 day week – Took a half day off to wipe out my HSA at the Dentist. … I don’t think you need a picture for this. I had a new mouthguard fitted ($400!) and spent the rest of the afternoon coloring with my Momma.

Week 4: Merry Christmas! I had a 3 day week surrounded by 5 family Christmas events! Oofda! That’s a lot of family! It was surprisingly lovely. No fights, not a lot of politics, good food and smiling faces.

Week 5: Happy New Year’s Eve! I had another 3 day work week and another dentist appointment. Orthodontic, actually. I went to get a new lower mouthguard (The Bruxism is strong with this one!) but my current one fits so well, they didn’t want to replace it. I’m proud to proclaim that it’s been ~15 years since I got my braces off and 9 years since my last orthodontic appointment and my retainers fit so well, you’d think they were brand new. My orthodontist was incredibly impressed.

Enough about my teeth, it’s time for the numbers!

[flashback]

December 2014: I owed $15,908 on my student loans and $13,302 on my car. I calculated that if I hadn’t been throwing extra cash at my loans, I’d have just over $40k left then and roughly $36k still to pay today!

December 2013: My student loans came due! All $45,33o of them. I made my first payment of $525 on December 23, 2013.

I started getting closer to what I wanted in a job. I took a sharp turn after passing the bar to think for myself. It took about 4 months of meetings, coffees and interviews to figure that out. So if you are looking for a job, be patient and figure out what you want! Find the right place for you!

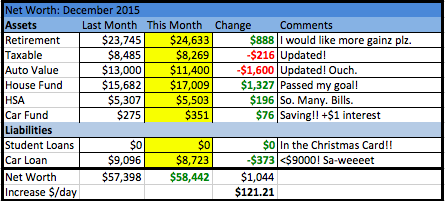

December 2015: Look at all the updates!

Assets!

Retirement: $24,633 (+888) Not the best month. This was a three paycheck month so I had a little help. I landed just shy of $25k invested but I am excited to break through that barrier with gusto in 2016.

Taxable: $8,269 (-$216) An update! Finally! I have this invested in a mutual fund and the share price took a huge tumble in the last few days of 2015. Like a 9% tumble. OUCH! This account didn’t end up where I wanted, even with an incredible boost from dividends. I had my best year for dividends yet!

Auto Value: $11,400 (-$1,600) Two negatives in a row! This is not a good trend. Oh well. I don’t plan on selling my car anytime soon, so this number doesn’t matter. I set myself up for monthly updates from KBB and I’m excited to see how this number bumps along. $1600 seems like a big drop, but who knows. I’d rather be aware of it than bury my head in the sand.

House Fund: $17.009 (+1,327) I am so excited to announce that I’ve started to save Thing 2!! Yippee! It was not quite the progress I had hoped for with 3 paycheck opportunities to save, but it is a great milestone nonetheless. December’s saving was plagued by expensive credit card payments. I had the rest of the trip to pay for and some other miscellaneous expenses. I will sacrifice house fund progress to ensure I never pay a drop of credit card interest. This, I promise you.

Round Two Progress: (What is Round Two? check here!)

- Baby Saver: $2125 ✔

- Middle Saver: $7953 (Loan value: $5828) ✔

- Thing 1: $16,453 (Loan value: $8500) ✔

- Things 2: $24,953 (Loan value: $8500) >>In Progress<<

- JOY! $17,009 saved, $7944 to go!

- Big Momma: $45,330 (Loan value: $20,377)

HSA: $5,503 (+196) This account isn’t supposed to be this high. I made a boo- boo. So you know those medical bills I was strategically delaying over the last 2 updates, well, I actually forgot to pay one. I wrote out the payment slip and had it all ready to go in the mail. But then with such a crazy schedule over the last two weeks of the year, I forgot to mail it! It didn’t get in the mail until 2016! Bad Kate! Once that bill hits my account, I should get back to regular growth in this account.

Car Fund: $351 (+76) 3 paychecks AND I crossed $1 in interest. Things are really looking up here. This account would be even more impressive had I not raided it so many times to buy during the dips.

Liabilities!

Student Loan: $0! Happy 9 months student loan free to me!

Car Loan: $8,723 (-$373) Under $9k! How exciting, especially in the face of a $1600 drop in my car value. Having this debt paid off at a normal speed has been a bit odd, but I’m enjoying the self control to leave it alone.

Overall:

- Net worth: $58,442. Up $1,044 from last month.

I’ll be honest. This isn’t where I want it to be. I was expecting to break through $60,000 this month. I was on track to hit it before the market tanked and I updated my car value. I don’t want to be disappointed in this number because I don’t have anything to be disappointed about. I can’t control this and this is a good lesson to learn while the numbers are small.

- Net worth increase: $121/day

The final number! Over the year, my net worth increased $121 per day! I achieved my goal of $100/day!

And there you have it, my final net worth update of 2015!

How are did you finish out the year?

Sometimes I really hate wordpress, which just ate my comment. Short version: markets suck, you’re doing good things, eventually it’ll grow again at the rate you want, yay vacation!!!

Damnit WordPress! I hate it when that happens. It happens to me far too often!

The markets stopped us both from reaching our NW goals this month. We should stage a boycott… Except keep investing anyway. 😉 Someday it will help us out!

Hooray for some good milestones in here! And for continuing your net worth/day increase through the end of the year! Just curious — are you planning to update these numbers with your combined finances at some point? I know you mentioned that, but seems like these are all still just your portion. On our end, we finished the year well, but are now significantly down from where we were on December 31, so — yay! Market fun! I think you’re right that it’s good to learn the less about market fluctuation when your amounts aren’t huge, but honestly that doesn’t make it all that much easier. Okay, that’s not actually true. I *know* that big dips don’t mean much, which is good, but the hard part is feeling like we’re moving backwards on our goals. I like to move forward on goals, and when the current pushes us the wrong way, I am never happy about it, even though it ain’t our first rodeo. I’m just mixing all the metaphors now, so time to wrap this up. Happy Tuesday!

No plan to add Hubs into the numbers. I have a joint account tracker that includes his numbers, but I don’t expect to add them to this party. The numbers here are a limited snapshot of the dollars. I also don’t include my emergency fund, checking account balances, or travel fund. If I didn’t have the car loan, I probably wouldn’t include any of the car stuff either. Funny, how net worth can be calculated so differently. I guess mine is more a “This is what I’m working on these days” tracker.

It’s a bit of a bummer to hear that it doesn’t get better. Maybe it hurts more but you are (hopefully) more emotionally prepared to deal with it. Sorry you “lost” so much money. Cheers to a February Rally!

Gotta love the fact that you didn’t work full week for the entire month of December. Now that’s something. Looks like you’re making very solid progress when it comes to your net worth. That’s awesome. Here’s to a great 2016!

I know, right? It was a leisurely December, and thankfully not that cold!

Thanks for stopping by Tawcan! An excellent 2016 to you too!

Congrats on surpassing your net worth goal of over $100 per day, that’s awesome!! Your vacation time sounds like it was amazing, did you enjoy Hogwarts?! My fiance & I will be experiencing a visit there on our honeymoon next July. Keep up the incredible progress!!

Thanks Alyssa! I did enjoy Hogwarts. It’s very well done. I’m a HP fan and Hubs is not. He still enjoyed it. If you are going in July, I recommend staying at one of the on-site hotels to get the extra hour at the Park.

$100/day? That’s a very impressive target in my opinion, and if that happened while you skipped working for an entire week in December, it’s even better! And might I add, the back of your head looks amazing in that photo 🙂 Good fun in the water!

I may not have worked an entire week in December, but never fear, I got paid for all of December. That makes paying the bills a little easier.

YOU WENT TO HOGWART’S WITHOUT ME?!?!?

*full of envy*

I did… You can go too! A ticket to Orlando is all it takes 🙂